FX netting is a process that consolidates multiple intercompany payments into a single net payment for each currency pair. This reduces transaction costs, simplifies reconciliation, and helps manage currency risk. Instead of processing separate payments between subsidiaries, companies calculate net balances and settle them in one go, cutting down on fees, administrative work, and exposure to exchange rate fluctuations.

Here’s why it matters:

- Cost savings: Fewer transactions mean reduced bank fees and better FX rates.

- Simplified reconciliation: Consolidated payments make accounting easier and faster.

- Lower currency risk: Centralised management allows for better timing and hedging of FX transactions.

- Automation: Modern systems integrate with ERP platforms, reducing manual errors and delays.

- Improved compliance: Standardised processes ensure smoother audits and adherence to regulations.

While the benefits are clear, implementation can be challenging. It requires a centralised treasury, compatible systems, and staff training. Upfront costs and aligning processes across subsidiaries are common hurdles. However, with proper planning and expert support, companies can achieve smoother intercompany settlements and long-term savings.

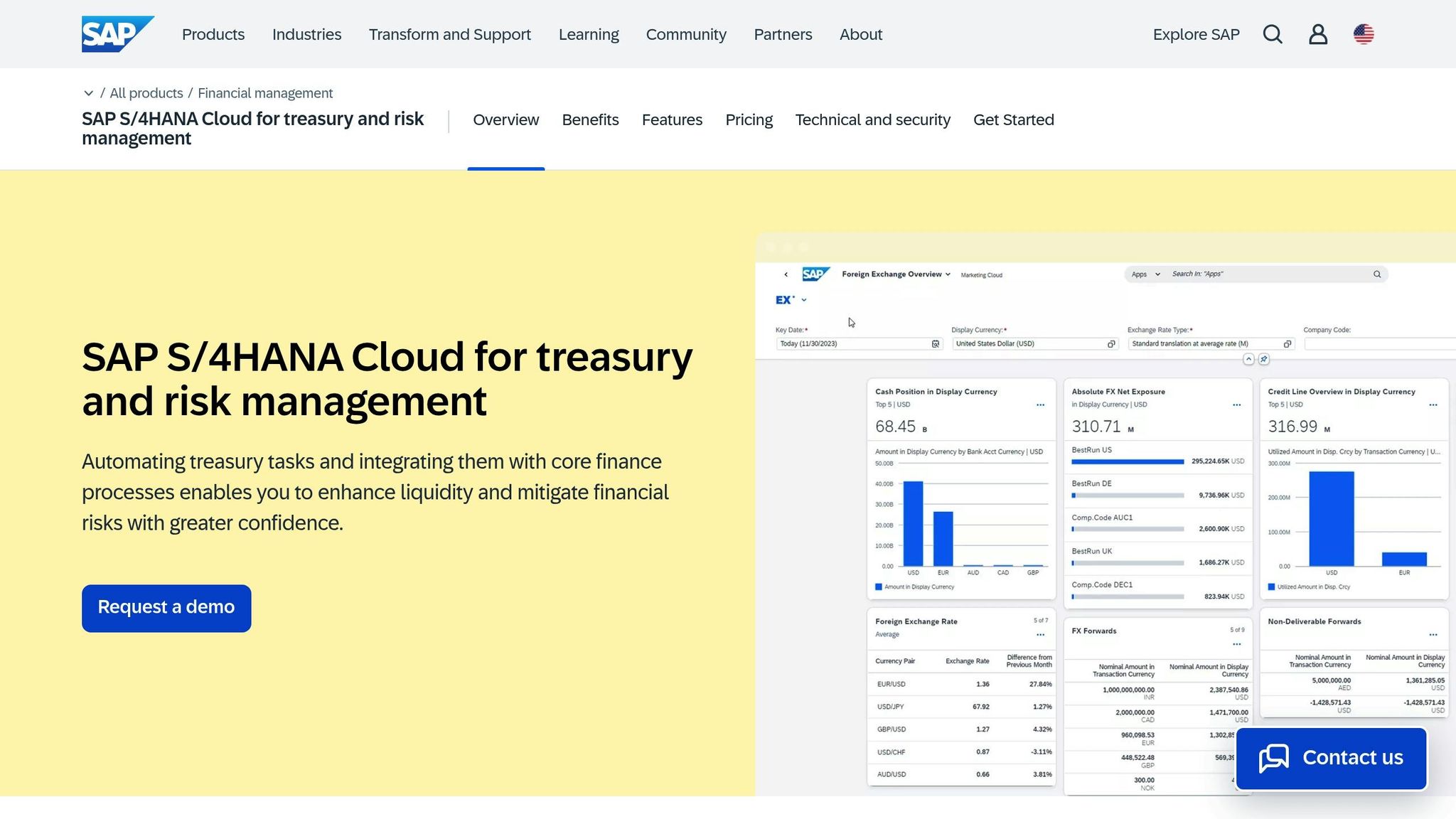

SAP Treasury | Intercompany Netting Within In-House Banking

Common Problems in Intercompany FX Settlements

Managing foreign exchange (FX) settlements across multiple subsidiaries can quickly become a logistical headache for multinational companies. Traditional approaches often involve fragmented and complex payment systems, with each subsidiary handling its own transactions. As businesses expand, this decentralised setup leads to inefficiencies in FX conversions, reconciliation, and compliance processes.

High Transaction Volumes

Handling a large number of transactions puts immense pressure on finance teams. From managing documentation and approvals to navigating banking arrangements, the workload can quickly spiral. For businesses operating across regions like Europe, Asia, and the Americas, the sheer volume of intercompany payments each month can significantly increase costs.

Banks charge fees for international wire transfers regardless of the amount, and these charges grow with each transaction. On top of that, companies face foreign exchange spreads and correspondent banking fees. When multiplied across numerous payments, these costs can become substantial.

The administrative strain doesn’t stop there. Finance teams must juggle payment schedules across multiple time zones and maintain relationships with various banking partners. This manual coordination often causes delays, adding to the overall complexity and cost of the process.

FX Conversion Costs

Currency conversions are an unavoidable cost in intercompany settlements, and traditional systems often make the process more expensive than it needs to be. Banks typically apply a spread above the mid-market rate for conversions, further increasing expenses.

When subsidiaries handle payments independently, they’re exposed to currency fluctuations at different times. For instance, a UK-based parent company might find that its European subsidiaries convert pounds to euros at varying rates simply because their payment timings don’t align.

This lack of coordination makes effective hedging nearly impossible. Treasury teams struggle to get a clear picture of overall currency exposure, which can lead to either over-hedging - tying up unnecessary capital - or under-hedging, leaving the company vulnerable to exchange rate volatility.

Complex Reconciliation

Reconciling intercompany transactions is another major hurdle. Each subsidiary typically maintains its own accounting records in the local currency, while the parent company must consolidate this data for group reporting. When payments are processed separately, discrepancies are almost inevitable.

Timing differences and delayed payments make reconciliation even harder. Exchange rate fluctuations between the initiation and settlement of transactions can create mismatches, forcing accounting teams to spend significant time resolving minor discrepancies. This manual intervention not only delays month-end closings but also adds to the overall workload.

Emerging markets add another layer of difficulty. Settlement times and banking relationships in these regions can be more unpredictable, further complicating reconciliation efforts.

Regulatory Compliance

On top of operational challenges, regulatory requirements make intercompany settlements even more demanding. Different jurisdictions impose varying rules, documentation needs, and anti-money laundering (AML) checks, all of which add complexity to the process.

For example, transfer pricing regulations require companies to prove that intercompany payments are made on arm’s length terms. This means maintaining detailed documentation for every transaction. Tax authorities also scrutinise these arrangements closely, and failure to comply can lead to issues like permanent establishment risks or withholding tax obligations.

AML regulations further complicate matters. Banks may request additional documentation for transactions involving high-risk jurisdictions, delaying payments and disrupting cash flow planning. These delays are particularly problematic during peak processing times.

Beyond individual transactions, companies must maintain clear audit trails that demonstrate the purpose of each payment, how pricing was determined, and compliance with local laws. Managing these requirements for a high volume of transactions is far more challenging than it would be with consolidated net settlements, adding yet another layer of complexity to an already burdensome process.

How FX Netting Works

FX netting simplifies the intricate web of intercompany payments by turning it into a well-coordinated, efficient process. Instead of each subsidiary handling its own foreign exchange (FX) transactions, netting consolidates payments into a centralised system, cutting down on complexity and costs.

Transaction Consolidation

At its core, FX netting works by offsetting payables and receivables between group companies, resulting in a single net payment per currency pair. This approach not only reduces the number of transactions but also introduces structure with scheduled netting cycles and measurable reductions in transaction volumes. For instance, instead of processing six separate intercompany payments, all obligations can be consolidated into one net payment, significantly simplifying the process.

The timing of these netting cycles - whether weekly, bi-weekly, or monthly - depends on the company's cash flow needs. During each cycle, all intercompany obligations are gathered, calculated, and reduced to the smallest possible number of payments needed to settle balances. This systematic approach enables a centralised and more manageable way to handle FX transactions across the organisation.

Centralised Management

Once transactions are consolidated, a central treasury team takes over, acting as the operational hub. This team oversees the entire process, offering a bird's-eye view of the company’s FX exposure and cash flow across all subsidiaries.

The netting centre collects transaction data from each subsidiary, verifies the figures, and calculates the net positions. It also manages FX conversions, ensuring they occur at optimal times and rates. Instead of subsidiaries converting currencies independently - often at varying rates throughout the month - the treasury can strategically time conversions or use hedging strategies to shield against unfavourable rate changes.

Centralisation also opens the door to bulk FX transactions, which often attract better rates. For example, consolidating £2 million worth of currency trades into one large transaction typically secures more competitive pricing than processing ten separate £200,000 trades. This approach translates to noticeable cost savings.

Additionally, the central treasury maintains consistent relationships with banking partners and ensures uniform documentation across all transactions. This standardised process reduces compliance risks and makes audits far less daunting.

Automation and Standardisation

Modern FX netting systems lean heavily on automation, which significantly reduces the manual effort traditionally tied to intercompany settlements. These systems integrate seamlessly with ERP platforms, automatically capturing intercompany transactions, validating data, and flagging any discrepancies. They also enforce standardised cut-off times across subsidiaries, ensuring predictable cash flow management.

Automation doesn’t stop there. It extends to regulatory reporting and documentation, generating standardised records for each netting cycle. This not only meets transfer pricing requirements but also creates clear audit trails, eliminating the need for manual record-keeping and ensuring consistency in intercompany agreements.

Integration with banking platforms further streamlines the process. Once netting calculations are finalised and approved, payment instructions are sent directly to banks without the need for manual input. This reduces processing time and eliminates errors that can occur with manual data entry, making the entire process faster and more reliable.

Pros and Cons of FX Netting

FX netting comes with its share of benefits and challenges. Here's a closer look at what makes it appealing and the hurdles that may arise during its implementation.

Main Benefits

One of the standout advantages of FX netting is cost reduction. By consolidating numerous smaller transactions into larger, net payments, companies can cut down on banking fees and simplify payment processing.

Another advantage is better control over currency fluctuations. Centralising currency conversions allows treasury teams to time these transactions strategically. This approach, coupled with hedging strategies, helps reduce the impact of unfavourable exchange rate shifts.

Automation is another game-changer. It simplifies reconciliation by generating standardised, audit-ready reports, which can significantly speed up month-end closing processes for finance teams.

FX netting also improves compliance. Standardising intercompany transactions makes it easier to manage transfer pricing documentation, regulatory reporting, and audit trails. This reduces the risk of compliance issues and ensures smoother regulatory oversight.

Potential Downsides

However, FX netting isn't without its challenges. For starters, the upfront costs can be steep. Setting up the necessary technology infrastructure, integrating systems, and maintaining them over time requires a considerable investment. This is especially true when aligning netting software with existing ERP systems.

Centralising FX management also introduces operational challenges. Establishing a central treasury function may require hiring skilled professionals or training existing staff. Additionally, some subsidiaries may resist this shift, seeing it as a loss of control over their cash management.

The process of standardising procedures across multiple subsidiaries can also lead to administrative complexity. Coordinating different time zones, local banking relationships, and diverse accounting practices demands meticulous planning and can cause short-term disruptions during the transition phase.

There's also the risk of technology dependency. If the netting system experiences downtime or technical issues, it could delay the entire intercompany settlement process. To mitigate this, robust backup procedures and reliable technical support are essential.

Comparison Table

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Transaction Costs | Reduced banking fees through consolidation | High initial investment in technology and integration |

| FX Risk Management | Centralised hedging and strategic timing | Requires specialised expertise and careful market timing |

| Operational Efficiency | Automated reconciliation and standardised reporting | Complex implementation across multiple subsidiaries |

| Compliance | Easier documentation and audit trails | Harmonising processes across jurisdictions can be challenging |

| Cash Flow Visibility | Clear view of group-wide financial positions | Demands a robust technology infrastructure |

| Resource Allocation | Less manual work for local finance teams | Needs dedicated, skilled staff for centralised management |

For businesses managing a large volume of intercompany transactions, FX netting can bring notable improvements in efficiency and cost savings. However, it requires a well-thought-out implementation plan to address its complexities and risks effectively.

How to Implement FX Netting

Implementing FX netting successfully involves thoughtful preparation and a well-organised plan. It’s about laying the groundwork properly and addressing both technical and operational needs.

What You Need First

To start, a centralised treasury is key. As Corpay explains, "a centralised treasury, with an intercompany netting program, is a prerequisite for each of those strategies [POBO, COBO, & IHB]". Without this, managing FX netting becomes significantly harder.

Another critical component is data consolidation. Your business needs the ability to pull accounts payable and receivable data from various ERP and accounting systems into a single, unified database. Without this step, it’s impossible to get a clear picture of intercompany transactions.

Next, you’ll need a strong technology infrastructure. GTreasury highlights this by stating, "Implementing FX netting at scale demands enhanced visibility, and control. That's where the right technology can make all the difference". The right tools can simplify processes and improve overall efficiency.

Lastly, consider your organisation’s complexity and available resources. The structure of your intercompany relationships and the expertise within your treasury team will determine whether bilateral netting (between two entities) or multilateral netting (across several entities at once) is the best fit for your business.

Once these elements are in place, you can move on to the actual implementation.

Implementation Steps

With your foundations set, here’s how to proceed with implementing FX netting:

- Map intercompany flows: Identify high-volume, multi-currency relationships and potential challenges. This step ensures you understand where netting will have the most impact.

- Set netting cycles: Most companies choose monthly cycles, as they strike a good balance between efficiency and cash flow management. However, depending on transaction volumes, weekly or quarterly cycles may work better. Establish clear cut-off dates for reporting and confirming intercompany transactions.

- Standardise documentation: Create templates for transaction reporting, confirmation processes, and dispute resolution. Consistency across subsidiaries helps reduce errors and avoid delays.

- Integrate systems: This is often the trickiest part. Many older systems aren’t compatible, and subsidiaries may use different platforms. Start with subsidiaries that already have compatible systems and significant transaction volumes.

- Train your staff: Ensure local finance teams understand the new reporting standards, and equip your central treasury team with the skills to use netting software effectively.

- Pilot the process: Test the system with a few subsidiaries by running parallel processes. This helps identify gaps and ensures accuracy before rolling it out fully.

- Monitor and report: Set up systems to track netting efficiency, cost savings, and operational issues. Regular reviews allow you to fine-tune the process and demonstrate its value to senior leadership.

On average, implementing FX netting takes 6–12 months, depending on your organisation’s size and the complexity of its systems. Taking the time to do it right ensures smoother adoption and minimises disruptions across subsidiaries. Rushing through the process often leads to mistakes and lower overall effectiveness.

sbb-itb-6b3a4a4

How Oku Markets Supports FX Netting

Implementing FX netting successfully isn’t just about having the right tools - it’s about having the right partner. Oku Markets brings a wealth of expertise in currency management, offering tailored solutions to help businesses tackle the challenges of intercompany settlements with confidence.

Custom Risk Management Plans

Every business faces its own set of FX risks, which means one-size-fits-all solutions just don’t cut it. Oku Markets takes the time to understand your unique intercompany structure and transaction patterns, crafting customised risk management strategies that address your specific exposures.

Their expertise goes beyond basic hedging. They work with businesses to integrate FX netting into their broader treasury operations, ensuring that reducing currency risk aligns smoothly with existing cash flow management practices. This integrated approach helps avoid inefficiencies or conflicts between financial strategies.

A key tool in their arsenal is forward contracts, which play a vital role in FX netting. When your netting cycle identifies net exposures in certain currencies, Oku Markets can help you secure favourable exchange rates for future settlement dates. This combination of netting efficiency and rate protection strengthens your ability to manage intercompany currency risks effectively.

These strategies don’t just stand alone - they’re designed to work seamlessly with your broader currency management efforts, as outlined below.

Complete Currency Management Services

FX netting is just one piece of the puzzle. Oku Markets offers a comprehensive suite of services to support intercompany settlements from start to finish, ensuring a smooth and efficient process.

Their global payments platform simplifies net settlement transfers, cutting out the hassle of coordinating with multiple providers. Once final amounts are determined, this platform ensures that transfers are executed efficiently.

For businesses managing relationships across multiple subsidiaries, collection accounts provide an invaluable tool. Acting as central clearing points, these accounts make it easier to track and consolidate transaction data for effective netting calculations. They also improve visibility into cash flows across different entities and currencies, giving treasury teams a clearer picture of their overall financial position.

Oku Markets also provides expert FX analysis, offering insights into market conditions that could influence settlement costs. Rather than simply processing transactions, they guide treasury teams on the best timing for net settlements and which currencies to prioritise for hedging. This proactive approach helps businesses make smarter, more informed decisions.

By combining these services with a focus on education and transparent pricing, Oku Markets ensures clients are equipped to succeed.

Client Education and Clear Pricing

One of the biggest hurdles to successful FX netting is a lack of practical knowledge within organisations. Many treasury teams understand the theory but struggle to put it into practice. Oku Markets bridges this gap with client education programmes that focus on real-world application.

These programmes teach clients how to interpret netting reports, spot optimisation opportunities, and resolve common operational challenges. By building internal expertise, businesses can get the most out of their netting programmes and adapt them as their needs evolve.

Alongside education, Oku Markets prioritises transparent pricing, removing the guesswork that often complicates FX netting decisions. This clarity allows treasury teams to accurately calculate cost savings and focus on achieving their currency management goals.

With personalised support tailored to each client’s situation, Oku Markets ensures businesses - whether new to netting or refining existing systems - have the tools and guidance they need to succeed. From education to execution, they’re there every step of the way.

Conclusion

FX netting simplifies intercompany settlements by consolidating multiple transactions into a single net payment. This approach helps businesses save on costs, streamline reconciliation processes, and gain better control over currency risks. With automation and centralised management, netting systems significantly reduce the workload for treasury teams.

The benefits are clear: fewer transactions mean lower costs, standardised reporting makes operations smoother, and central oversight helps manage risks more effectively. However, achieving these advantages depends on proper system integration, clear processes, and consistent management to ensure the desired efficiencies are realised.

A strong technology platform, well-defined governance, and properly trained staff are essential for a successful implementation. This structured approach ensures that both technical and operational challenges are effectively addressed.

Expert support can make a big difference. Oku Markets offers a comprehensive solution by combining risk management, currency services, and client education. Their transparent pricing and tailored service approach empower businesses to make informed decisions and see measurable results from their netting programmes.

FAQs

What challenges might businesses face when using FX netting, and how can they overcome them?

Challenges in Implementing FX Netting

Introducing FX netting into a business isn't always straightforward. Companies often face hurdles like operational risks, especially when relying on a centralised netting system. Then there’s the issue of high costs, which can arise from cross-border transfers and currency conversions. On top of that, coordination with counterparties can be tricky, making the process even more complex. And let’s not forget the challenge of managing FX settlement risks, which can become a headache without the right tools or systems in place.

To tackle these challenges, businesses can turn to automated netting systems. These systems help streamline operations and cut down on the risk of errors. Another key solution is adopting well-thought-out strategies to align FX and settlement workflows. This ensures smoother collaboration with partners and can significantly reduce costs. By combining the right technology with expert advice, companies can make FX netting not just manageable but far more efficient.

How does FX netting help businesses comply with regulatory requirements across different countries?

How FX Netting Supports Regulatory Compliance

FX netting plays a crucial role in helping businesses meet regulatory requirements by tackling settlement risk and systemic risk - two major concerns for financial regulators. Many regulatory frameworks recognise netting's ability to minimise these risks, which can also lead to reduced capital requirements for businesses.

Additionally, FX netting aligns with international standards like the FX Global Code, which emphasises robust risk management and effective settlement risk controls. By simplifying workflows and reducing exposure to risks, FX netting enables businesses to operate smoothly while maintaining compliance across various jurisdictions.

How does automation in FX netting improve the efficiency of intercompany settlements?

Automation in FX Netting

Automation in FX netting transforms intercompany settlements by combining multiple transactions into a single netted payment. This approach cuts down the total number of transactions, reduces foreign exchange (FX) exposure, and speeds up processing times.

By taking manual effort out of the equation, it improves accuracy and simplifies reconciliation. It also shortens settlement cycles, helping businesses save money, manage cash flow more effectively, and reduce operational challenges.